Loan Origination System

Expand reach. CloudBankin's Loan Origination System:

Your all-in-one digital lending solution.

Loan Origination System (LOS) - Introduction

Streamline Your Loan Products

Launch in just 2 days

Diversification

Create products for a wide variety of clients with agile, custom workflows for differing products.

Business Presence

Faster onboarding and agile processes support scaling your business easily, allowing you to expand and grow organically!

Low Code Platform

Adding new features or making tweaks to your current systems is a breeze with a low-code platform that improves workflows.

Upgrade Your Existing Systems

Easy integration into your existing systems enables seamlessly transitioning to a bigger and better business.

Operational Efficiency

Reduce costs and turnaround times for your onboarding processes with real-time progress tracking and analytics along with automation.

Key Features

Client Onboarding

Adding new clients is made easy with automated processes geared towards seamless onboarding.

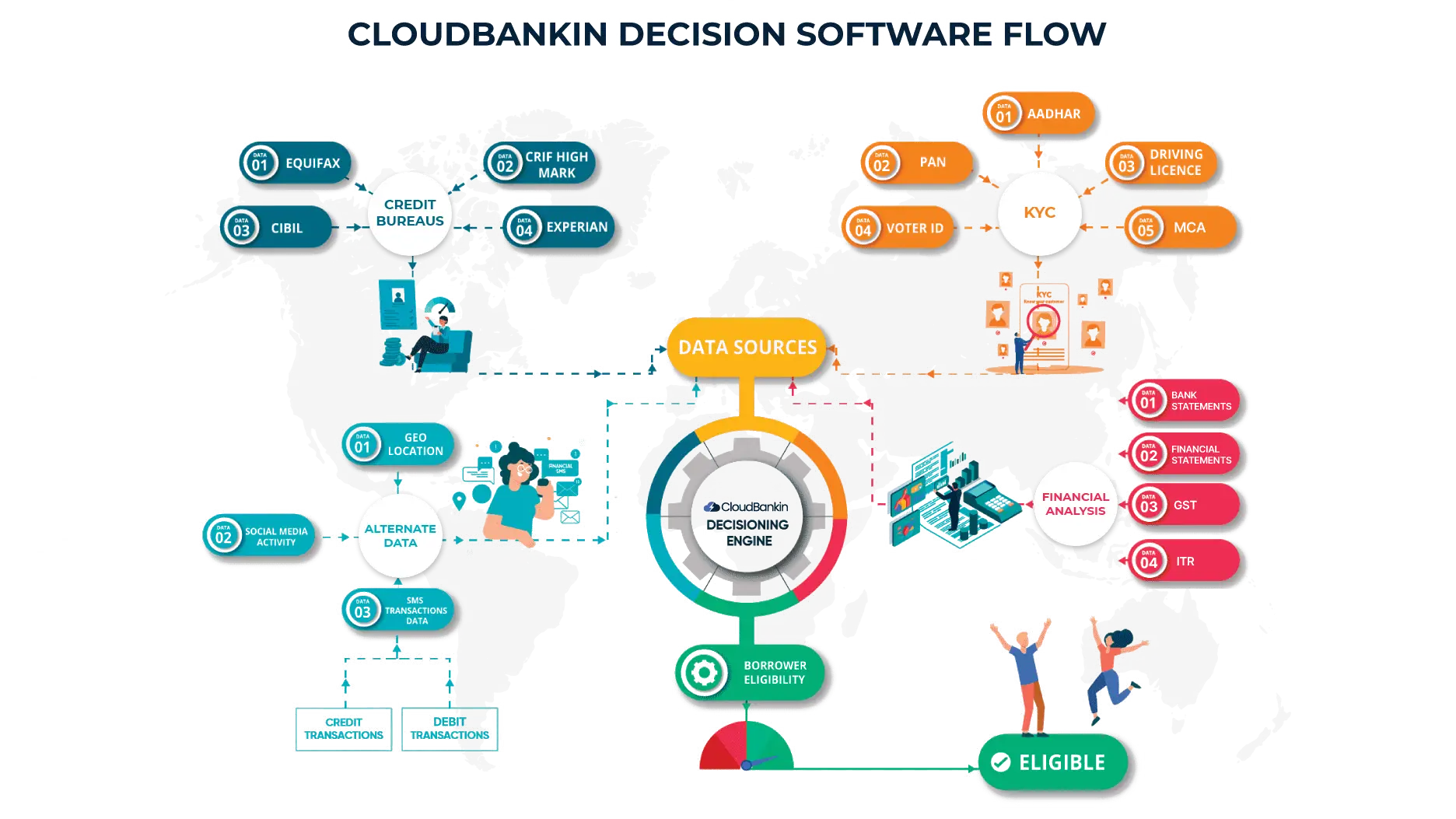

e-KYC Process

Collecting requisite documentation for regulatory standards becomes a breeze with a fully digital e-KYC system

Credit Bureau Integrations

Assessing customers’ credit scores is seamless and hassle-free with CloudBankin, allowing faster decisioning

SMS Analysis

Analyze clients’ messages to understand their spending patterns and expenses to gain insights into their lifestyle

Quick Decisioning Engine

Inbuild credit rule engine with configurable parameters based on your lending institutions credit policies and rules

Mobile Application

CloudBankin works across devices, providing continuous access to critical systems and data through a secure, integrated platform

Why Choose the CloudBankin Loan Origination Software?

Quick Decisioning

A quick decision-making algorithm works under the hood to generate, customize and export a variety of reports that can help you evaluate customers’ credibility and also potential expansions and new products!

Cost Efficiency

Easily configurable workflows allow you to increase operational efficiency while simultaneously reducing costs, making profitability a part of your business’ DNA! (CloudBankin’s Loan origination system software (LOS) offers automated processes and configurable workflows, increasing operation and cost efficiency).

Product Diversification

A host of features work in tandem towards scaling your business, providing ease of product diversification and also allowing you to expand your geographical presence.

Quick Implementation

It is a low code solution that boasts of a quick implementation time of as low as 24 hours!

Self-Assisted Journey For Your Borrowers

Overcoming the main obstacle that prevents your borrowers from applying for a loan on their own. Let your borrower take loans from anywhere, at anytime and from any device because our loan origination process is completely branchless, paperless, contactless and agentless!

Frequently Asked Questions

What is a loan origination system (LOS)?

A loan origination system(LOS) is a platform that is used by financial institutions to automate and oversee the complete end-to-end loan process from application to loan disbursement.

How long does it take to disburse a loan using CloudBankin?

Loan disbursement (Unsecured Loans) can be done within 10 minutes.

How is automation enhancing the loan origination process?

With the integration of different APIs, customer onboarding is done seamlessly without any manual intervention and a paperless process. Our configurable rule engine will help you define your underwriting parameters from different sources like KYC, Bank Statements, Credit Bureau and Alternate data and make your decision process quicker. With this automated solution, you will be able to auto-approve and disburse the loans (Unsecured loans) within 10 minutes.

What are the stages of the loan origination process?

The stages in the process of loan origination are Data Collection - With information about the borrower obtained from various sources, the lender will concentrate on key parameters such as credit history, cash inflow, collateral, and character. Minimum Risk Assessment Criteria - borrowers are evaluated on various factors such as age, income, pincode, etc., to keep loan default percentage to zero. KYC, where borrowers' documents like Proof of Address (POA) and Proof of Identity (POI) are collected and analysed. Credit Bureau Check - to establish borrowers' credit scores on factors like credit repayment history, credit utilisation history, current loan portfolio, credit line tenure, credit inquiries made thus far, and so on. Loan Underwriting - borrowers’ creditworthiness is assessed in risk percentage for loan approval on credit score, debt, income, and collateral value. Video KYC, where borrowers’ identities are ensured on conditions mandated like geotagging, borrowers only in the specified location, only trained loan officers to execute the process, liveliness check, image to be captured to validate against the borrowers’ documents, and so on. Loan Negotiation, where the final terms of the loan are determined between lenders and borrowers. E-Mandate - allowing lenders to collect repayments from borrowers automatically in a series of steps. Loan Contract - which is drafted with terms and conditions and signed. The document includes basic information about lenders and borrowers, loan specifics, method and time frame of repayment, acceptable payment methods, interest rate, etc. Disbursement of Loan - loans are disbursed by lenders to borrowers.

Is CloudBankin a loan origination system (LOS)?

Yes, Cloudbankin is a digital loan origination system. It provides lenders with an easy-to-use, secure, and scalable platform for digitally onboarding borrowers and providing them with a seamless user experience.

Does CloudBankin support online payments?

Yes, CloudBankin supports online payments. We have payment gateways integrated for automated disbursal of loans and direct debit (E-mandate) from the customer's bank account for collection.

What does origination mean in finance?

Origination in finance, specifically loan origination, in simple terms, is a process where borrowers apply for loans, and lenders lend them after a series of steps. It includes data collection, verification, underwriting, negotiation, contract & signature and loan disbursement.

What is difference between LOS and LMS?

A loan origination software is where financial institutions are able to automate and manage the loan life cycle from application to disbursement. Whereas a loan management system starts right after disbursement till the closure of the loan.

Which features in the loan origination software are automated?

Automation is used to streamline the loan origination process, increase loan officers' productivity and give your borrowers a better user experience. Automation plays a role in the following features of Cloudbankin: 1. Customer Management - Manual collection of borrower data (POI, POA and other documents) becomes cumbersome, and the possibility of incorrect data entry is high. Automation mitigates the inaccuracy, inconsistency and delays in data collection by facilitating web portals and various APIs to onboard borrowers easily. 2. Credit Analysis - Allowing automation in assessing borrowers' creditworthiness (underwriting) and screening them using data from KYC credit bureau reports, bank statement analysis, alternate data (SMS and more) etc., reduces errors unlike manual processes and saves a tremendous amount of time. 3. Credit Decisioning - With our automated rule engine, you can verify client information, accelerate your decision-making process and quick loan approval for your borrower in 2 minutes. How does automation enhance and benefits the loan origination process? Ensure uniformity in the overall loan origination process Reduce errors Lower risks Boost the loan approval of applications Online data collection Reduce paperwork Streamline borrowers experience Other benefits of automation are reducing human intervention, cost-effectiveness, and many more.

Is the LOS configurable to your Organization?

Yes, our LOS is configurable. For instance, 1. We have integrated the credit bureau (Equifax) into our platform, so all you need to fetch your borrowers' credit reports is your licence key. 2. To configure "n" number of parameters in the rule engine, it is easily integrated to add or modify parameters (conditions) that aid in making credit decisions when evaluating your borrowers. 3. Configure product master - simply by adding new parameters in data fields for interest rates, principles, repayments, loan terms, repayment strategies, moratoriums, etc., you can create a new product. The aforementioned examples demonstrate that no human assistance (from developers) is needed for them. To that extent, Cloudbankin is configurable.

Is the LOS Safe and Secure?

Yes, our LOS(Loan origination system) is completely safe and secure. Every data is often stored in a completely encrypted and centralised dedicated tenant-based system with firewall in our cloud-based loan origination system. To guarantee that systems and data are secure at all times, our team combines battle-tested technologies, open-source strategies (like OWASP), strong cloud infrastructure (like AWS), Monitoring System (Prometheus, Graphana), Penetration testing (VAPT), Audit Logs, Application Level User Access Control and risk/security processes & policies. Lenders don’t have to depend on the legacy system’s hardware and the chance of them getting hacked. This makes sharing and updating data with only authorized and trustworthy people within the business a safe and quick manner. Accessing the LOS becomes much easier from any browser, thereby increasing the simplicity and time management efficiency for lenders and their borrowers. This also provides a high level of transparency and access control from any location, device and time.

Is the LOS User-Friendly and Modern?

Yes, our loan origination software is modern and user-friendly. With our rule engine, we have automated quick credit decision-making by integrating different APIs to pull large amounts of data from different sources like CKYC Credit Bureau, Bank Statement Analyser, and alternate data. By harnessing the capabilities of integrating modern web technology (React, Angular, Capacitor), we are able to lower customer acquisition costs, increase customer value proposition, maintain transparency, and many more features. We also support personalized SMS/email notifications and alerts for a superior customer experience. These are just a few examples of how we provide a user-friendly and modern experience with our LOS.

Is the LOS SaaS-Based?

Yes, CloudBankin is a Saas-based loan origination software. The benefits of using our cloud-based LOS are: 1. Access the software whenever, wherever you want, using any device. 2. Everything is over the cloud. There is no need for in-house infrastructure. 3. Our software is integrated with different APIs to harness borrowers’ data from different sources. You have quicker time-to-market.

Does the LOS Offer a Point-of-Sale?

Yes, our loan origination system supports point-of-sale lending, for example, BNPL. You can easily enhance your business using our Buy-Now-Pay-Later software. Check out our BNPL page for more details.

Related Articles

- Email: [email protected]

- Sales Enquiries: +91 9344243151

- HR Enquiries: +91 9080996576

Quick Links

Resources

© 2024 LightFi India Private Limited. All rights reserved.

(Formerly known as Habile Technologies)

After smartphone penetration, people are not watching their SMS at all. They use SMS only for OTP related transactions. That’s it.

But What can a Lender see in your SMS after you consent to them?

Lender can see income, expenses, and any other Fixed Obligation like (EMIs/Credit Card).

1) Income – Parameters like Average Salary Credited, Stable Monthly inflows like Rent

2) Expenses – Average monthly debit card transactions, UPI Transactions, Monthly ATM Withdrawal Amount etc

3) Fixed Obligations – Loan payments have been made for the past few months, Credit card transactions.

It also tells the Lender the adverse incidents like

1) Missed Loan payments

2) Cheque bounces

3) Missed Bill Payments like EB, LPG gas bills.

4) POS transaction declines due to insufficient funds.

A massive chunk of data is available in our SMS (more than 700 data points), which helps Lender to make a credit decision.

#lendtech #fintech #manispeaksmoney